Market Update: June 2023

Question: What happens to financial markets during the first half of a year when you have a banking crisis, the threat of a U.S. default, the unexpected slowing of the world’s second largest economy, a surge in commercial real estate loan defaults and rising interest rates?

Answer: Bull market!!!!

The first half of 2023 has been great for the most part. Many of last year’s worst performers, tech stocks, for example, have been this year’s best performers. If you predicted this would happen at the beginning of the year, good for you. You must be pretty smart. (Definitely smarter than me, anyway!)

Given my conversations with investors and clients, however, I suspect that most of you did not see this coming.

If you have been sitting on the sideline so far this year because of your “gut feeling”, I suggest rethinking your strategy. Unless you went to cash right at the beginning of 2022, my “gut” tells me you are worse off at this point than if you had stayed invested.

One of the more frustrating aspects of investing is that avoiding mistakes is often a better recipe for success than rigorous analysis and forecasting.

How Did We Get Here?

Essentially, none of the worst-case scenarios panned out. As the saying goes, “Stocks love to climb a wall of worry.”

As I mentioned in my missive at the beginning of the year, while the ensemble of indicators I look at was negative on balance, one of the indicators with the most predictive power, investor sentiment, was extremely bearish, suggesting above average returns over the next 6-9 months .

All in all, the combination of negative sentiment, earnings that largely beat expectations, avoidance of disasters, and downward trending inflation have resulted in a great first half for 2023.

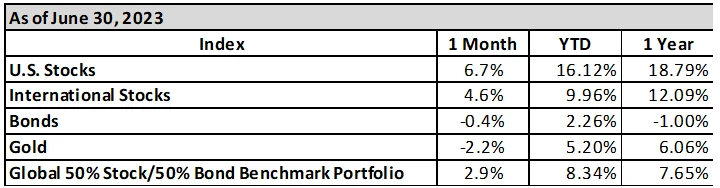

Global Indices

- The tech heavy NASDAQ index is leading the pack, up 31% year to date.

- U.S. value stocks, one of last year’s best performing asset classes, have lagged greatly this year, rising a paltry 2.5%.

- Bonds have erased much of their gains from the beginning of the year, as interest rates have risen back to around 3.8% on 10 Year Treasury Bonds.

Portfolio Positioning

- Overweight short-term government bonds.

- Underweight long-term bonds, as they still don’t represent a good value in the current environment.

- Overweight technology and Mexican stocks.

- Underweight Europe and China.

Moving forward

- The array of indicators we use has moved from moderately negative to moderately positive. We look for extremes in either direction before reducing or increasing risk, and the way things stand now, the best course of action is to go with the flow.

- Japanese stocks look attractive presently. Not only are they historically cheap, selling at an average of less than half of their book value, but Japanese companies have been increasing cash flows at a rate not seen in decades and there is reason to believe they can continue doing so.

- Stock market returns tend to be lower than average during the summer months. And with things already stretched, don’t be surprised if there is a 7%-10% sell-off. Unless credit conditions deteriorate meaningfully, or the sell-off is the result of an external shock, you would likely want to buy on any weakness.

- High double digit returns for U.S. stocks over the course of a calendar year is the norm rather than the exception. Over the last 95 years, a full 27% of calendar year returns have been greater than 20% while a quarter of calendar year returns have been between 10% and 20%. In other words, typical calendar year returns tend to be much higher than the 10% average often quoted, so don’t be surprised at a strong finish to the year despite all that could go wrong.

- A meaningful spike in volatility along with deteriorating credit conditions would force us to take on a more conservative stance.

Steven Neeley, CFP® is an investment advisor representative of and offers investment advisory services through Fortress Capital Advisors LLC, a registered investment advisor offering advisory services in the State of Indiana and other jurisdictions where registered or exempted. Main office: 4841 Industrial Pkwy, #139, Indianapolis, IN, 46226. Tel: (317) 210-3727.

Sources

The return data for the indexes in the table comes from PortfolioVisualizer.com, an online software platform for portfolio and investment analytics.