Market Update October 2022

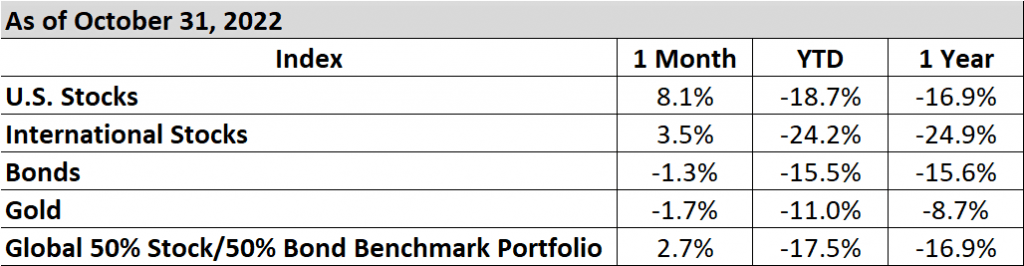

Things are looking up. As I mentioned in last month’s newsletter, our sentiment indicators pointed to a rally off the bottom, and we got exactly that. U.S. stocks rose over 8% last month. International stocks were also up, but to a much lesser degree, as Europe continues to struggle on many levels and China remains almost uninventable.

What’s happening out there?

- Corporate earnings season for Q3 is more than halfway over and it hasn’t been great, especially for tech stocks. (Mark Zuckerberg has lost over $100 billion this year. Don’t feel sorry for him though, as he’s still worth $38 billion!)

- So, if earnings haven’t been good, then why did the stock market rise so much last month? The short answer is expectations: many were expecting an all-out earnings crash; instead, earnings were relatively flat.

Portfolio Positioning

- We didn’t make any changes during October. In general, we are underweight international stocks, overweight quality U.S. stocks (i.e., companies that have low debt, high profitability, and are reasonably priced), and positive on bonds. We also remain partially hedged.

Moving forward

- Recession still remains the base case over the next 6-12 months. If it’s a run-of-the-mill recession, then stocks are pretty much fairly valued at the moment. If something breaks during the recession, e.g., a big bank becomes insolvent, and a major recession occurs, stocks have a long way to drop from here.

- The good news is that bonds are priced attractively for the first time in years.

- Keep in mind, also, that there is definitely a chance, albeit slim, that both stocks and bonds rally into year-end, erasing much of this year’s losses. What would it take? Demonstrable evidence that inflation is trending down, giving the Federal Reserve Bank reason to ease up on tightening.

Miscellaneous

For those of you in Indiana, I hope everyone was able to get out and enjoy some of the beautiful fall weather we’ve had. We were able to make it down to Brown County State Park to enjoy the fall foliage, which was stunning.

As always, feel free to get ahold of me if you’d like to discuss the financial markets in more detail, or if you have any other questions or concerns for that matter. Hope you have a wonderful Thanksgiving!

Yours,

Steven

Steven Neeley, CFP® is an investment advisor representative of and offers investment advisory services through Fortress Capital Advisors LLC, a registered investment advisor offering advisory services in the State of Indiana and other jurisdictions where registered or exempted. Main office: 4841 Industrial Pkwy, #139, Indianapolis, IN, 46226. Tel: (317) 210-3727.

Sources

The return data for the indexes in the table comes from PortfolioVisualizer.com, an online software platform for portfolio and investment analytics.