Market Update September 2022

Can someone please make it stop?

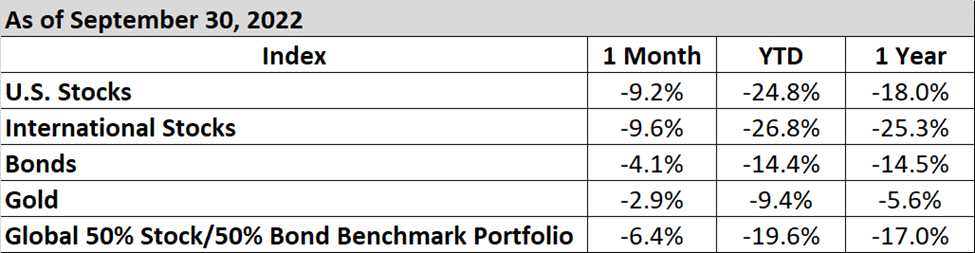

September, traditionally the worst month of the year for the stock market, stayed true to form as stocks fell more than 9% during the month. If you look at the chart below, it’s been a brutal year across the board.

What’s happening out there?

- As I mentioned last month, the biggest driver of returns this year has been selling based on the fear that the Federal Reserve Bank is going to crash the economy in order to bring inflation under control. In September, those fears continued driving returns, as the Fed came out with a hawkish stance on the path of interest rates moving forward.

- The housing boom is over. Prices posted the biggest monthly declines since 2009 according to an article in Bloomberg today.

- Further dampening sentiment is the fact that the prices of many industrial commodities are in a free fall.

- The strong U.S. dollar is wreaking havoc around the world and risks igniting crises in many countries.

Portfolio Positioning

- We continue following our strategy and remain defensively positioned due to the indicators we use, which is working out really well. I will say that we are expecting a bit of a rebound at some point in the next couple of weeks as the selling has gone too far in the short term according to our models.

- We are still significantly underweight international stocks given the never-ending stream of bad news coming out of nearly every corner of the globe. I’ve seen a lot of strategists argue lately that international stocks are cheap compared to U.S. stocks and primed for outperformance. While that may be true in the long run, there is simply no reason to start buying international stocks until it’s clear the global economy is heading out of a recession, not into Until that time comes, we won’t be taking on the extra risk.

- Short-term Treasury Bonds have become attractively valued for the first time in years, which means you will see us adding positions this month. Yields have now reached close to 4%. On top of that, owning Treasuries will help blunt the impact of a major recession.

For those of you that are my clients, I know it’s scary out there, but remember, you have a plan and things are working out accordingly. Nothing that’s happening right now is a surprise, and the risk management strategy we employ is doing what it’s supposed to.

Miscellaneous

It was pretty hot right up until the official last day of summer. I think the temperature broke 90 degrees that day in Indianapolis, but it sure has been gorgeous ever since. My family and I are really looking forward to taking some day trips over the next couple of weekends to enjoy the fall foliage.

If there’s one silver lining to everything that’s been happening in the markets, it’s that the U.S. dollar goes a long way abroad right now, so if you’ve been putting off an overseas trip due to Covid, now is a great time to consider going. I can tell you that Italy is a fantastic place to be in October.

As always, feel free to get ahold of me if you’d like to discuss the financial markets in more detail, or if you have any other questions or concerns for that matter. Take care.

Yours,

Steven

Steven Neeley, CFP® is an investment advisor representative of and offers investment advisory services through Fortress Capital Advisors LLC, a registered investment advisor offering advisory services in the State of Indiana and other jurisdictions where registered or exempted. Main office: 4841 Industrial Pkwy, #139, Indianapolis, IN, 46226. Tel: (317) 210-3727.

Sources

The return data for the indexes in the table comes from PortfolioVisualizer.com, an online software platform for portfolio and investment analytics.