How Much Do I Need to Retire?

Introduction

Type “How much do I need to retire?” into a search engine and you’ll be inundated with offers from various financial institutions to use their free online retirement calculator. But how good are these free calculators and should you use one?

After putting a couple to the test, I’m skeptical that these calculators provide any real value and I’m going to show you why you should be, too. While free online calculators may seem like an easy and convenient way to plan for retirement, they can be misleading and inaccurate, leading to misguided decisions.

Here’s a list of reasons why you should be wary of using a free online retirement calculator to determine when to retire:

Lack of customization: Online calculators are designed to be a one-size-fits-all solution. They use general assumptions about things like life expectancy, inflation rates, and investment returns.

Incomplete information: Online calculators only consider the information that you input. They do not take into account external factors that can significantly impact your retirement plans, such as unexpected healthcare costs or changes in the economy.

Overly optimistic assumptions: Free online calculators often use overly optimistic assumptions about investment returns and inflation rates. While these assumptions can make the calculations seem more favorable, they do not accurately reflect the realities of the market.

Limited scope: Online calculators can only provide estimates based on the information that you input. They cannot provide personalized advice or take into account the complex interplay of financial and non-financial factors that impact your retirement plans.

Retirement Calculator Comparison

I could go on about the limitations, but I figure the best way to prove that online retirement calculators are worthless is by demonstrating it.

I compared the results of the top two free online retirement calculators that came up in my search (Bankrate.com and Nerd Wallet) to the results I get by using paid financial planning software from eMoney.

While I did my best to ensure that the assumptions used were identical, this wasn’t always possible. Still, the four biggest assumptions (savings, expenses, inflation and investment growth rates) were identical in all cases. Despite this, I got three wildly different results!

Here are the baseline assumptions for our hypothetical pre-retiree:

- Age-55

- Retirement Age – 62

- Life expectancy - 88

- Current Savings - $675,000

- Income- $180,000

- Monthly Savings - $1,500

- Annual Retirement Expenses – 96,000

- Annual Retirement Income - $60,000

- Pre-Retirement Investment Return % - 6%

- Post Retirement Investment Return % - 5%

Now let’s look at the results.

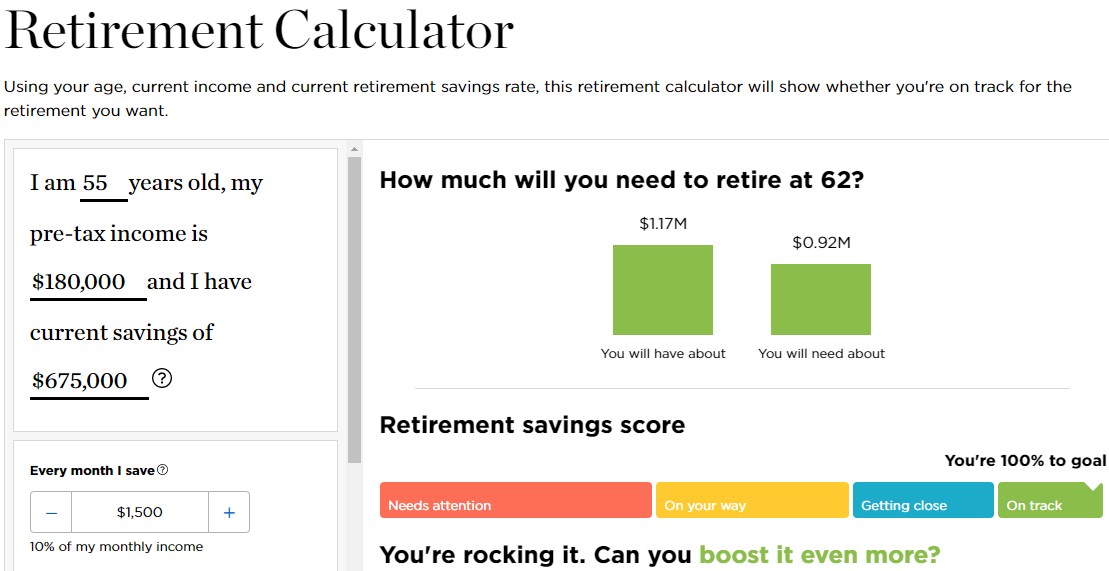

1. Nerd Wallet

According to Nerd Wallet, you are on track and would be more than 100% funded for retirement by age 62. Keep it up!

2. Bankrate.com

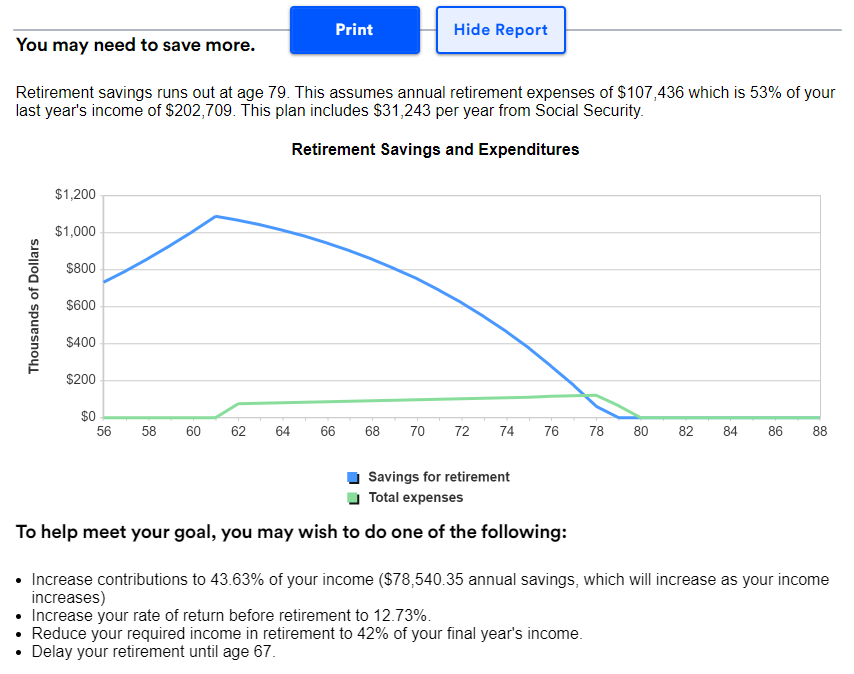

Well, that’s… interesting.

Bankrate.com’s calculator shows you being underfunded and running out of money at age 79 while Nerd Wallet shows that you will be overfunded. What gives?

The obvious difference in the assumptions is the retirement income. Nerd Wallet asks you to input an estimated retirement income amount while Bankrate.com calculates your estimated Social Security income based on your current earnings. It does not, however, allow you to factor in other income from pensions, real estate rentals, etc. This is a major limitation.

Another difference to point out is how the results are displayed.

Nerd Wallet’s results show the total amount you will have saved by your desired retirement age versus the total you will need through your lifespan. You have no idea at what age the money runs out or, if fully funded, how much you would have remaining at death.

Bankrate.com’s results, on the other hand, show at what age your money will run out, but not how much money you will need saved by the time you hit retirement.

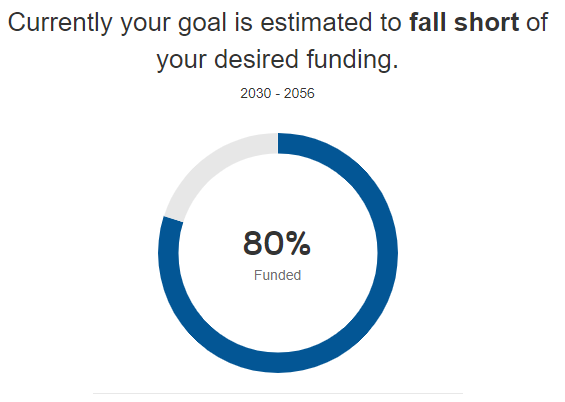

3. eMoney

eMoney is the fancy, paid financial planning software I use with my clients. (*Note- the inputs are exactly the same as the ones I used for Nerd Wallet, i.e., I was able to assume $60k of retirement income.)

Despite using the exact same assumptions that I used with Nerd Wallet’s calculator, eMoney gave me a very different result, showing only 80% funded. Not good.

Interestingly, eMoney showed the client running out of money at age 79, the same age that Bankrate.com showed. This should not be the case, however, because Bankrate.com assumes a much lower retirement income than I assumed with eMoney: $31k per year versus $60k per year.

With that big of an income discrepancy, there’s no way you should get the same result.

Black Box Assumptions

The main reason we are getting different answers is because of the black box nature of the free calculators. While you are aware of the main assumptions that the calculator is using, you have no idea what other assumptions are being used behind the scenes.

For example, both free calculators ask you how much you have in savings. Neither asks you what type of account your savings is in, however. As you’ll see in a moment, the account type makes a huge difference.

The other major assumption that free calculators make for you is taxes. Neither calculator mentioned taxes, so you don’t know if they are estimated or even factored in at all.

While seemingly minor, the assumptions used regarding account type and taxes can make a very big difference in the outcome.

Let’s look at another example to illustrate this point.

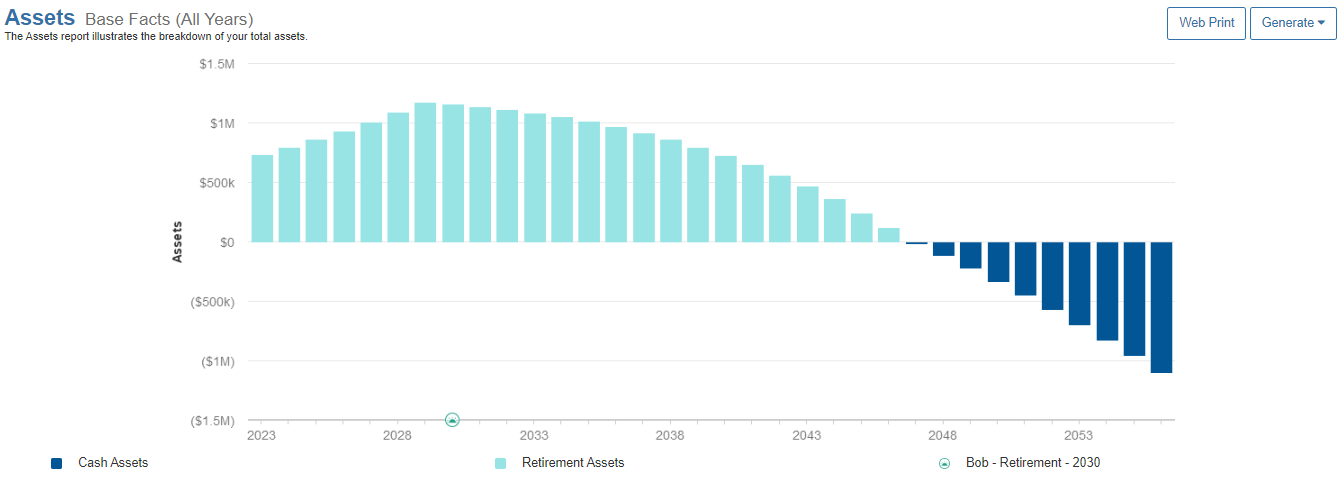

4. eMoney – taxable account

What I didn’t mention earlier is that in my original scenario with eMoney, I assumed that all of our pre-retiree’s savings was in her 401(k). Further, I assumed her savings from 55 to 62 was also going into her 401(k).

It follows that she will withdraw from her 401(k) to pay for living expenses during retirement, a taxable event. Additionally, I let the software estimate her taxes using her income while assuming that she lived in Indiana for state tax purposes.

What type of savings account was used in our Nerd Wallet and Bankrate.com analyses? We don’t know, as neither one offers up that information. Same with the taxes. We have no idea how they are calculated. It’s a black box.

Now back to the taxable account scenario using eMoney. This time, I kept all assumptions the same except that instead of her savings being in a 401(k), I assumed that her savings is in a taxable brokerage account. (I also had to estimate what percentage of the account’s earnings would be taxed at long-term capital gains, ordinary income and qualified dividends. Something else the free calculators don’t allow.)

Here are the results:

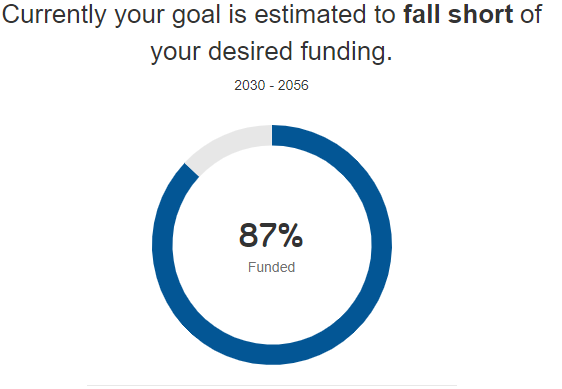

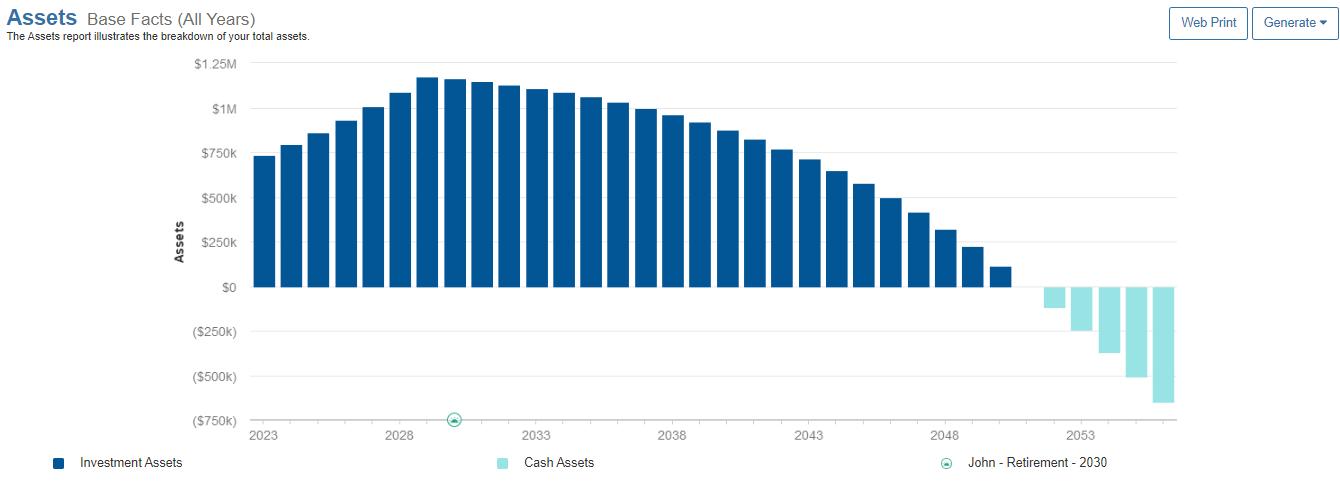

This time, our pre-retiree is 87% funded versus 80% and makes it to age 84 before running out of money instead of 79.

That’s a staggering difference due to just one change in assumptions: the account type.

The Devil Is in the Details

All four scenarios produced roughly the same total savings values by retirement at age 62, somewhere around $1.1 million, which makes sense given the identical savings rates and investment returns.

From that point, however, the results varied dramatically. The reason is that details matter a lot. Look at the huge difference made by doing nothing more than changing the account type.

Unfortunately, you will never be able to rely on a retirement plan generated using a free online calculator because they simply aren’t customizable enough to produce accurate results.

If you want to have a successful retirement, you need to consider multiple scenarios using varying assumptions.

Professional retirement plans consider so many factors that free retirement calculators can’t:

- What if you downsize during retirement?

- What if you move from a high-tax state to a low-tax state?

- Do you front load travel for the first 5-10 years?

- How many new vehicles will you need?

- What if you have to spend more on health care costs?

- Are you planning on leaving a legacy?

- Are you charitably inclined?

- When should you begin taking Social Security?

- Should you take a lump sum or an annuity payout from a pension?

- What is the impact of doing Roth conversions between retiring and taking required minimum distributions?

- If you have multiple account types (traditional IRA, Roth IRA, brokerage, etc.) in which order should you draw them down?

I could go on, but you get the picture.

Conclusion

Not only are free online retirement calculators worthless, but they might also harm you if rely on them to retire earlier than you really should.

The good news is that you can purchase comprehensive financial planning software for a reasonable price. If you are a do-it-yourselfer, financially savvy, and confident in your assumptions, this is a great option.

Personally, I believe nearly everyone would be better off having a professional run a comprehensive retirement plan for them. Yes, I’m aware of my bias, but hear me out.

The value of using a professional isn’t in their ability to predict the future (they can’t) or even necessarily their technical knowledge (though technical knowledge helps). The value comes from their experience in successfully guiding others through a similar situation. They know what works and what doesn’t work. They also know which assumptions are realistic.

Even if you are a do-it-yourselfer, there’s a ton of value in getting the perspective of an experienced professional. There are so many things that you likely have never considered that are routine to a good financial planner.

In closing, run a comprehensive financial plan and skip the free calculator.